Thinking about starting your own business in New Zealand? It’s a brilliant thought, and you can absolutely do it. Really. At its heart, it’s all about having a solid idea, sketching out a plan, getting the official stuff sorted with the Companies Office and IRD, and then—the best part—finding those first few customers. You've got this.

We’ve all had that lightbulb moment, haven't we? That little spark where you think, 'Hey, I could turn this into something real!' If that’s you, you're in exactly the right place. Every great business in Aotearoa started with that same flicker of inspiration.

Let's be upfront: it's not always a walk in the park. It's going to take some real grit, more than a few late nights, and a good old-fashioned dose of Kiwi ingenuity. But honestly, the entrepreneurial spirit here has never been stronger.

If you’re thinking of forging your own path, you're in excellent company. You’d be joining a huge community of like-minded people. In fact, small businesses are the very backbone of our economy. The total number of enterprises in New Zealand has reached a provisional 617,330.

And get this: businesses with fewer than 20 employees make up a staggering 97% of that total. You can check out the full breakdown over on the Stats NZ website.

So, what does that actually mean for you? It means there's a well-trodden path to follow and a really supportive ecosystem ready to help you succeed.

This isn't just another dry checklist. Think of this guide as your first chat with a mentor over a flat white—a chance to map out the exciting road ahead and get the reassurance that, yes, you can absolutely pull this off.

We're going to walk through everything together, from stress-testing your idea to see if it has legs, right through to getting those first paying customers. It's all about taking that brilliant concept and turning it into a real, thriving business. Let’s get to it.

So, you've got that brilliant idea ticking away. It feels like a sure thing, right? But before you quit your day job and remortgage the house, let's figure out if it's just a cool concept or a genuine business that people will actually pay for.

This stage is all about validation. It’s where you shift from "I think this will work" to "I know who my customers are and what they want." And you know what? It doesn't have to cost a fortune. It’s about being smart and asking the tough questions before you're in too deep.

The first, most critical question is brutally simple: does anyone actually care? A brilliant solution to a problem nobody has is, well, just a fun hobby.

So, how do you find out? You have to talk to people. And no, your mum and your best mate don't count—they love you, and they’re biased! You need to get in front of your ideal customers, the real people you imagine pulling out their wallets for what you're offering.

Here are a few cheap and cheerful ways to do some initial digging:

Think of this as your first reality check. It’ll quickly tell you if your idea has legs or if it’s time to head back to the drawing board for a tweak. Before you commit serious time and money, it's vital to properly understand how to validate a startup idea and make sure you're building something people genuinely need.

Okay, so you've confirmed people are interested. What's next? You need to build a test version of your product or service. You’ll hear people in the startup world call this a Minimum Viable Product (MVP). It sounds a bit jargony, I know, but it just means "the most basic version of your idea that still delivers real value."

For example, if you dream of opening a gourmet sandwich shop, your MVP isn't fitting out a full commercial kitchen. It’s perfecting three killer sandwich recipes and selling them at the local weekend market. You get real-time feedback and actual sales, all without the massive overheads.

The point of an MVP isn't to be perfect; it's to learn. It’s designed to answer one question: "Will people pay for this?" The faster you can answer that, the better off you'll be.

Don't let the words "business plan" scare you off. I'm not talking about some dusty, 50-page document that gets written once and then shoved in a drawer forever. Forget that.

Think of your business plan as a living, breathing roadmap. It’s for you. It’s your go-to guide for keeping things on track. This is where you get clear on the fundamentals.

What problem are you solving? Who, specifically, are you helping? How will you make money? What do your first three months look like? Answering these questions forces you to be clear. It’s like planning a road trip across the country; you wouldn't just jump in the car and hope for the best, would you? This plan is your map for the exciting, and sometimes bumpy, journey ahead.

Alright, let's get into the part that can feel a bit formal and, let's be honest, a little intimidating. But I promise you, getting your business registered and legal in NZ is more straightforward than it seems. Think of it like getting your driver's licence—a few forms and rules to learn, but once it's done, you have the freedom to hit the road.

This is where your idea goes from a concept to a real, recognised entity. It’s an exciting step!

First things first, you need to decide what kind of business you are. In New Zealand, you've got three main choices, and the one you pick affects things like your personal liability, how you pay tax, and the amount of admin you'll have to do.

Picking the right structure from the get-go can save you a world of headaches later on. Let’s break down the most common options to see which one might suit you best.

A simple breakdown of the most common business structures in New Zealand to help you choose the right one for your startup.

| Structure Type | Best For | Liability | Key Consideration |

|---|---|---|---|

| Sole Trader | Freelancers, contractors, and one-person operations just starting out. | Unlimited – you and the business are legally the same. | Super simple to set up and manage, but your personal assets aren't protected. |

| Partnership | Two or more people starting a business together. | Unlimited and shared – you're all responsible for business debts. | A solid partnership agreement is non-negotiable to outline roles and responsibilities. |

| Company | Businesses planning to grow, hire staff, or seek investment. | Limited – your personal assets are protected from business debts. | More admin and compliance, but offers crucial liability protection. |

Deciding between these can feel like a big commitment, but it doesn't have to be. For a deeper look, check out our guide that really unpacks the sole trader vs company debate in NZ.

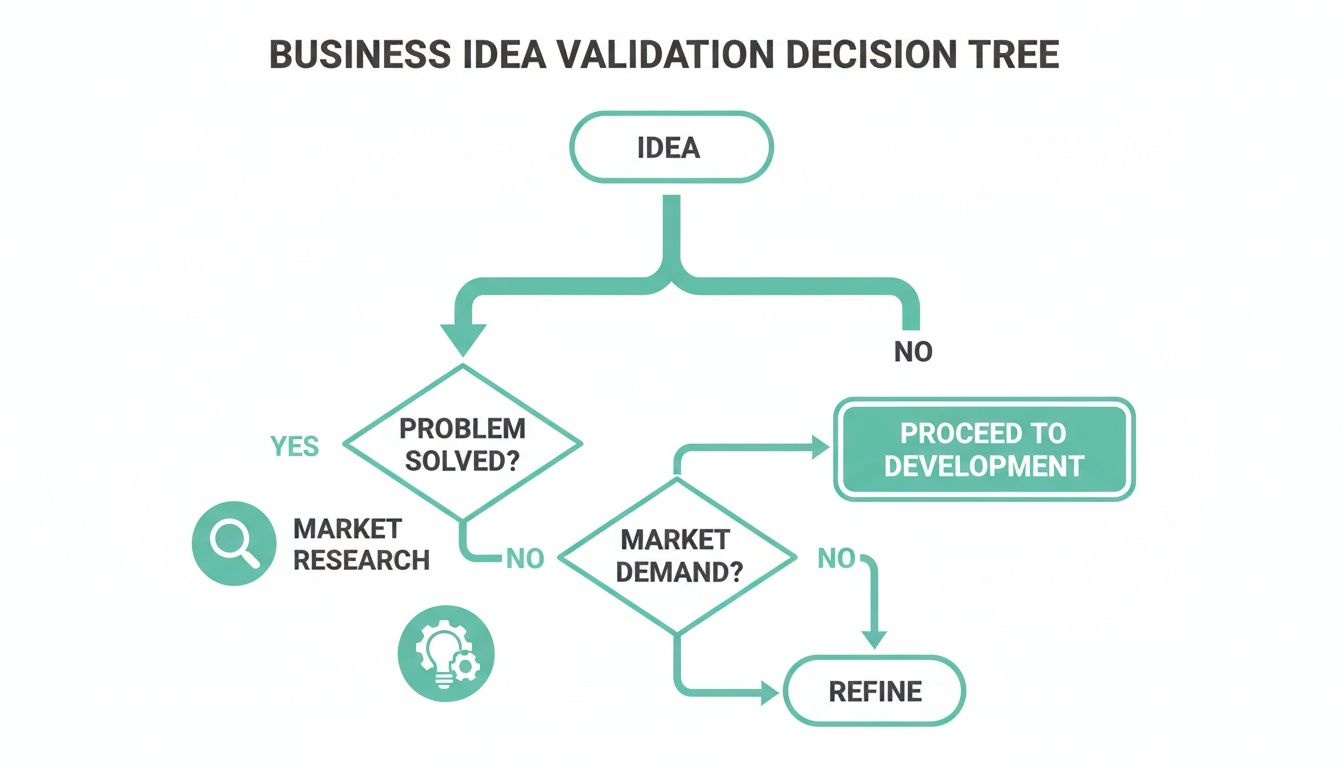

This simple decision tree can help you visualise the initial steps, from validating your business idea through market research to refining it.

This visual shows that every idea needs a reality check; either you move forward with research or you go back to the drawing board to strengthen it.

Once you’ve picked a structure (unless you’re going the sole trader route), it's time to register. This is where you’ll get to know the New Zealand Companies Office. It’s the official register for businesses and is surprisingly easy to use.

Here, you'll reserve your company name and officially register your business. This process gives you a New Zealand Business Number (NZBN), a unique identifier for your business. Think of it as your business’s IRD number—it helps other businesses and government agencies connect with you easily.

Now for everyone's favourite topic: tax. Getting set up with Inland Revenue (IRD) is a non-negotiable step. Every business needs an IRD number. If you're a sole trader, you can just use your personal one, but companies will need their own.

The big question we always get is about GST (Goods and Services Tax). Do you need to register?

Here’s the key takeaway: In New Zealand, you must register for GST if your annual turnover (your total sales before expenses) is expected to be more than $60,000 in any 12-month period.

What does that mean in practice? If you're starting a side hustle and predict you'll make $20,000 in your first year, you don't have to register. But if you're opening a café and project sales of $150,000, then you absolutely must.

You can also choose to register for GST voluntarily even if you're below the threshold. Why would you do that? Well, because it allows you to claim back the GST you pay on your business expenses—things like laptops, tools, or rent.

It can be a smart move, but it also means more paperwork, so have a chat with an accountant if you're on the fence. Getting this stuff right from the start saves so many headaches down the line. It's just one of those foundational things you'll be glad you sorted properly.

Right, let's talk money. It's often the biggest hurdle—and the biggest worry—when you're starting out. How on earth are you going to fund this brilliant idea? It's the question that can keep you staring at the ceiling at 2 AM.

But here’s the good news: you don't need a finance degree to get a handle on this.

Think of it like learning to drive. You don’t need to be a mechanic, but you do need to know what the dials on your dashboard mean. You need to watch your fuel (cash), keep an eye on your speed (sales), and make sure the engine isn't about to overheat (costs). It’s all about knowing where you stand so you can steer the business in the right direction.

Every business needs a bit of capital to kick things off, but that doesn't always mean a huge bank loan. For a lot of Kiwi businesses, the funding journey starts a lot closer to home.

Here’s the reality: no matter where the money comes from, you absolutely must have a crystal-clear picture of your numbers. Hope is not a financial strategy.

Before you earn your first dollar, there are a couple of habits you need to lock in from day one. Getting this right from the start will save you a world of headaches down the track, especially when Inland Revenue gets in touch.

First—and I can't say this loudly enough—open a separate bank account for your business. Please, don't mix your personal spending with your business income. It turns into an absolute nightmare to unpick and makes it impossible to see if you're actually making a profit.

Second, get yourself good accounting software from the get-go. I mean it. Tools like Xero (a true Kiwi success story) or MYOB are designed specifically for small businesses like yours. They link directly to your bank account, make invoicing painless, and take the stress out of GST returns. Trying to manage everything on a spreadsheet is a false economy; the time you'll save is worth every single cent.

Once you're trading, you need a way to check your financial pulse. This really just means getting your head around a few key ideas: cash flow, profit, and loss.

Cash flow is the absolute lifeblood of your business; it's the money coming in and going out. You can be profitable on paper but still fail if the cash runs out. Profit is what’s left after you've paid all your bills. And a loss... well, that’s when your expenses are bigger than your income.

Keeping a sharp eye on these figures is vital, particularly in the current economic climate. The recent Xero Small Business Insights data, for example, showed sales growth of just 1.9% year-on-year. While it's still growth, it's a step backwards in real terms once you factor in inflation. This really highlights the need for tight financial planning and looking for growth opportunities, like the professional services sector, which saw a healthier 2.4% sales increase. You can dig into more of this data on the Xero Small Business Insights New Zealand page.

This isn't meant to scare you. It’s about empowering you. Knowing your numbers gives you control. It helps you make smarter decisions, spot trouble before it spirals, and confidently guide your business towards a healthy future.

Let’s be honest, if your business isn't online in this day and age, it might as well be invisible. That’s not an exaggeration; your digital presence is the new front door, and it's often the very first impression a potential customer will have of you.

For any Kiwi small business, your website is your digital storefront. It’s your virtual office and your hardest-working salesperson, all wrapped into one tidy package. Think of it as your home base online—the one place you can send people to learn exactly who you are and what you stand for.

Picture this: you hear about a great new cafe or a recommended local tradie. What’s the first thing you do? You pull out your phone and Google them. If they have no website, or even worse, a clunky, slow-loading site that looks like it was designed in 2005, it immediately plants a seed of doubt. Doesn't it?

A professional, easy-to-navigate website builds instant trust. It doesn’t need to be flashy or complicated—in fact, simpler is often better.

At the absolute minimum, your website must nail these three fundamentals:

Getting your digital presence right from the start is a massive leg-up. A recent CPA Australia survey revealed that many NZ businesses are being held back by low adoption of e-commerce, with a tiny 8% prioritising innovation. This is a golden opportunity for a new business like yours to stand out. You can dig into the numbers in the full market summary from CPA Australia.

If the thought of building a site yourself feels a bit much, it's well worth exploring professional small business website design to make sure you start on the right foot.

Okay, so you’ve got a beautiful website. Fantastic! But what good is it if no one can find it? This is where Search Engine Optimisation (SEO) comes into play.

Don't let the three-letter acronym scare you. At its core, SEO is just the art of using the right words on your website so that your ideal customers find you when they search on Google.

It's that simple. If you're a plumber in Christchurch, you want to be the first name that pops up when someone types "plumber christchurch" into their phone. For any local business, this is non-negotiable. One of the most powerful first steps you can take is setting up a free Google Business Profile. This is what puts you on Google Maps and displays your hours, reviews, and phone number directly in search results.

The final piece of your digital puzzle is social media. It's so easy to feel overwhelmed, thinking you need to be on TikTok, Instagram, Facebook, and LinkedIn, posting five times a day. You don't. That's just a recipe for burnout.

The smart approach is to figure out where your customers actually spend their time online and focus your energy there. Are you a B2B consultant targeting other professionals? LinkedIn is probably your best bet. Do you sell beautiful handmade jewellery? Instagram and Facebook are likely where your community is. As you grow, it's wise to build out a proper digital marketing strategy for small businesses to keep your efforts focused.

Remember, the goal isn't just to rack up followers; it's to build a genuine community around your brand. Be helpful, join conversations, and show the human side of your business. Pick one or two platforms, do them really well, and you'll be miles ahead of the competition.

You’ve done it. The business is registered, the website is live, and your bank account is ready to go. And now… crickets.

It’s a strange, quiet moment, isn't it? A bit like throwing a party and waiting for the first guests to arrive. The hard truth is, a business without customers is just a really expensive hobby.

This final, crucial step is all about connecting with the people who need what you offer. Let’s shift our thinking away from hard ‘selling’ and move towards ‘helping’. Honestly, when you focus on genuinely solving a problem for someone, the sales part feels so much more natural and, well, human.

Your first goal isn't to land some massive corporate contract. It's to find your first customer. Then your second. Then your third.

Those initial clients are pure gold. They’re your proof of concept, your first testimonials, and the most likely source of your first referrals.

So, where do you find them? You start with your own network. No, not in a spammy, awkward way. Think about who you know that could genuinely use what you do, or who might know someone else who would. A simple, personal email or a chat over coffee can work wonders.

You don't need a massive marketing budget to make a splash. When you're just starting out, consistency is far more valuable than cash.

Here are a few simple but effective ideas to get things moving:

New Zealand is a small place. Everyone seems to know everyone, especially within business communities. This isn't a weakness; it's your greatest asset.

In a small country, your reputation isn't just part of your business; it is your business. One happy customer telling their friends about their amazing experience with you is more powerful than any paid ad you could ever run.

From your very first interaction, make customer service your obsession. Be responsive, be helpful, and be genuine. A happy customer doesn't just pay the bills—they become your most passionate advocate, your walking, talking marketing department.

Those relationships are the real foundation of a business that lasts. Go on, put yourself out there and start helping people. The revenue will follow.

When you’re starting a business, your head is probably swimming with a million questions. Don't worry, you’re not alone. Here are a few of the most common queries we hear from Kiwi entrepreneurs just like you, with straight-up answers to help clear the path ahead.

Honestly, this is the classic "how long is a piece of string?" question. There's no single magic number.

A service-based business run from your spare room might only cost a few hundred dollars for registration and a simple website. But if you’re opening a cafe or a retail store with physical products, you’ll need a lot more cash upfront for stock, rent, and fit-out.

The best approach is to create a lean startup budget. Get really granular and list every single potential cost you can think of—then add a buffer for those inevitable surprises. Many of the most successful Kiwi businesses get off the ground by bootstrapping, which is just a fancy way of saying they use their own savings to keep costs ultra-low at the start.

Not necessarily. In New Zealand, you only have to register for GST if your annual turnover is, or is likely to be, more than $60,000 in any 12-month period. If you’re starting small and don't expect to hit that figure in your first year, you can hold off.

Here’s a pro tip though: you can choose to register voluntarily even if you're below the threshold. Why would you? It lets you claim back the GST you pay on your business expenses (like a new laptop or your accounting software), which can be a huge help for your cash flow.

Absolutely! Heaps of Kiwi entrepreneurs begin their journey as a "side hustle" while holding down a full-time job. It’s a brilliant, low-risk way to test your business idea and build up some revenue before you take the big leap.

Just a heads-up: it's a good idea to double-check your current employment contract. You'll want to look for any clauses about outside work or potential conflicts of interest. It's also super important to be realistic about managing your time and energy to avoid burning out.

Feeling inspired to turn your idea into a reality? Whether you need a professional website to get started or a custom app to grow, the team at NZ Apps is here to help build the digital tools your new business deserves. Get in touch for a free consultation today!